Before the chic boutiques and overpriced cafés arrive, the first sign of gentrification is often a slew of ubiquitous posters stapled to telephone poles reading, “We Buy Houses.”

One is more than likely to find these illegally-placed advertisements in low-income parts of the city where desperation for fast cash can outweigh the benefit of long-term financial planning. It can be devastating to a family’s long-term wealth when they make this short-term decision.

So what happens when a city follows a similar path?

In 1997, the City of Philadelphia held liens on more than 33,000 tax delinquent private properties. These liens prevent a property from being sold until the owner pays off the taxes; each year the lien goes unpaid, penalties and interest accrue. With the city’s finances still recovering from the brink of bankruptcy in the early 1990s, then-Mayor Ed Rendell’s administration hatched a plan to sell these liens for $72 million to U.S. Bank in order to secure bonds to fund the school district.

Not too long after, the city defaulted on the bonds to the tune of $42 million. This was a black eye for the city at the time, and the effects of this decision are reverberating throughout Philadelphia to this day.

U.S. Bank and the national law firm it hired to collect on these liens, Linebarger Goggan Blair & Sampson, have managed to collect taxes, penalty and interest on 30,000 of these liens.

Although there are the occasions where the homeowner clears the taxes, oftentimes these liens are cleared through the sale of the property through sheriff’s sales.

According to Linebarger, there are approximately 2,777 U.S. Bank liens in their collections portfolio and, due to the surging Philadelphia real estate market, U.S. Bank and Linebarger are ramping up their efforts to close this chapter of Philadelphia history by aggressively collecting these liens, often by forcing a sheriff’s sale where deep-pocketed developers have the funds to clear the debts as they bid on the property.

In early January, advocates from the César Andreu Iglesias Garden Community and the Neighborhood Gardens Trust (NGT) began circulating a call to action in the Philadelphia gardening and advocacy community to partake in a “phone zap”—a coordinated effort of advocates calling government officials with a consistent script demanding action—to pressure Mayor Jim Kenney’s administration to buy back the remaining 2,777 tax liens in order to protect the “side yards, community gardens and open spaces.”

In a prepared script for supporters willing to make the call they stated: “Putting these lots in the [Philadelphia] Land Bank would be an important step in community control for our neighbors, while selling them to the highest bidder would only increase gentrification.”

The reason organizers such as Adam Butler call it the Iglesias “Garden Community” rather than “community garden” is that this language puts the land first. Made up of more than 30 parcels between North 5th and Lawrence streets in North Philadelphia, the garden was formed 10 years ago by neighbors who wanted to take advantage of the huge amount of vacant space. It is now used for growing food, hosting events and meeting space.

People are relying on these community gardens to eat. This is how they feed their families.”

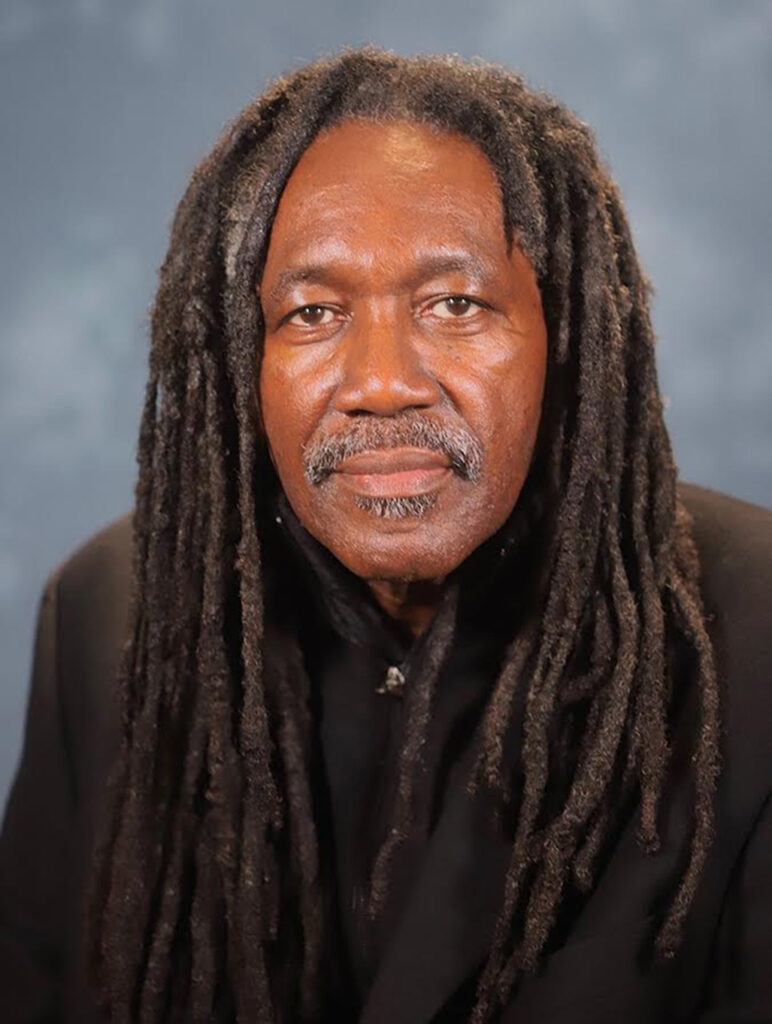

—Ebony Griffin, Public Interest Law Center attorney

Two of the lots that comprise an important part of the food-growing space are U.S. Bank-liened properties that were on the list for the January 6 sheriff’s sale, hence the urgency of the “phone zap.” In addition to their activism, Butler and other organizers have been working with entities like NGT to find a pathway to ownership.

Formed in 1986, NGT is Philadelphia’s land trust for the protection of community gardens and other shared open spaces. The group has been working in the city for the past four decades to secure land ownership or long-term leases for 50 community gardens experiencing insecure land ownership.

“A very common scenario is one where the community garden or part of a community garden might be privately owned and the owner of record abandoned the property decades ago and stopped paying taxes,” NGT executive director Jenny Greenberg explains. “So now the property is encumbered by liens often owed to the City of Philadelphia. But then there are also these U.S. Bank liens, and we have really hit up against a wall on figuring out how to secure these properties.”

One major problem is that if the city owns the property outright, as it still does on an estimated 10,000 vacant lots, then there is a much more direct, albeit challenging, path to work with a City Councilmember and garner community support for the city to at least remove the property from the sheriff’s sale list—and best case scenario, move it to the Land Bank where ownership can be transferred to a nonprofit like NGT to secure ownership on the property for long-term community garden use.

But Public Interest Law Center attorney Ebony Griffin points out: “When there’s a U.S. Bank lien on it, it’s privatized. So really the only entity that can postpone the sheriff’s sale indefinitely or pull the property off is the lien holder, which in these instances are U.S. Bank or more specifically, the collection agency that they’ve hired, Linebarger Goggan Blair & Sampson.”

Griffin adds that even if there’s no sheriff’s sales slated, U.S. Bank still can’t work with the Land Bank. “Because the Land Bank is, I believe, statutorily prohibited from acquiring properties that have U.S. Bank liens on them.”

Through the Public Interest Law Center’s Garden Justice Legal Initiative, Griffin and her team provide pro-bono legal representation to gardens and market farms throughout the Philadelphia region, mostly around land access.

What makes Griffin’s and Greenberg’s jobs even harder, they say, is that when they have approached U.S. Bank or Linebarger about removing the liens, both firms say that they lack the authority to do so.

While U.S. Bank representatives did not respond to a request for comment, representatives from Linebarger confirmed this, stating that all liens owned by U.S. Bank “must proceed through the litigation process and be foreclosed upon at sheriff’s sale if the tax liens have not been paid.”

“If a lien is satisfied through payment by the legal owner, the lien is released,” Linebarger’s team explains. “If the lien is not paid, judgment is rendered in favor of U.S. Bank and the property proceeds to sheriff’s sale.”

A city spokesperson explains that the proceeds of U.S. Bank lien sheriff’s sales go first to U.S. Bank, as the holder of the oldest city liens. If there is surplus from the sheriff’s sale, proceeds go to the city as the holder of any newer liens; to pay any water debt liens and licensing and inspection liens; and then to pay debt to any relevant private creditors. Any “excess proceeds” go to the former owner of the property, the spokesperson said.

“… a community garden might be privately

owned and the owner of record abandoned the property decades ago and stopped paying taxes.”— Jenny Greenberg, Neighborhood Gardens Trust executive director

Linebarger representatives reiterated that a sheriff’s sale is the mechanism under the law that allows for the lien to be alleviated for the property to be sold and anything short of a sheriff’s sale will not transfer ownership. However, the firm also said that many properties have been temporarily pulled from the sheriff’s sale list until a solution can be reached between U.S. Bank and the city due to “Land Bank interest or request by City Councilmembers.”

Linebarger also said that the liens are not their own, and that it is acting on behalf of a client to collect debt.

“Therefore [Linebarger] has no standing to offer any ‘options’ other than what is permitted under the contract entered into between the City of Philadelphia and U.S. Bank with [Linebarger] as the servicer of the liens, and the laws of the Commonwealth of Pennsylvania,” the firm says.

With neither Linebarger nor U.S. Bank seemingly able to make the decision to remove the liens so that an entity like the Land Bank can repossess the property, the mechanism of sheriff’s sale becomes the only path.

“A lot of times you’re looking at principal tax balances of $2,000 or $3,000,” Griffin explains when discussing the tax profile of many of these tax-liened properties in garden spaces. “But after taxes and fees and penalties, we’ve seen bills of upwards of $40,000 or $50,000.”

This can make owning community gardens built on tax-liened land especially difficult, she explains.

“Most Philadelphians working in community gardens don’t have that money,” Griffin says. “And most of the community gardens in Philadelphia are located in the lowest income neighborhoods in the city. People are relying on these community gardens to eat. This is how they feed their families.”

The liens, including penalties and interest, are only the beginning of the battle. Once the property is cleared of liens, there’s the additional cost of actually acquiring the property.

“Even in situations where we could try to fundraise to cover the cost of the liens and the acquisition, we’d be doing it at risk because we don’t own the property,” laments Greenberg. “One parcel in particular I’m thinking of has over $30,000 in tax debt. To raise that kind of money to pay off the liens, and then to look to the Philadelphia Land Bank, which is budgetarily limited in what they can afford to acquire every year, becomes a year-long process where we still risk losing the property and the money.”

Since U.S. Bank doesn’t seem to have the power to alleviate these liens other than through the mechanism of the sheriff’s sale, NGT, the Public Interest Law Center and the Iglesias Garden Community (along with the Pennsylvania Horticultural Society, Soil Generation and dozens of other gardens on tax-liened properties) are requesting that the city find a solution.

According to reporting by Samantha Melamed in The Philadelphia Inquirer in October 2021, the full cost of the liens (including penalties and interest) at that time was an estimated $25 million. In the piece, the Department of Planning and Development director Anne Fadullon bemoaned the fact that even though the city has tried to negotiate for some of the lots, U.S. Bank has taken an all-or-nothing approach.

“What’s happened is not that there hasn’t been political will,” Fadullon said at the time. “There hasn’t been the financial wherewithal with all the other budget priorities for the city to find that money.”

A city spokesperson elaborates to Grid that, to date, U.S. Bank has only offered to sell Philadelphia the entire portfolio of properties.

“Acquiring the entire U.S. Bank portfolio is not realistic financially,” the spokesperson says. “The city is willing to work with U.S. Bank to acquire individual properties that will advance neighborhood revitalization goals within the city’s budgetary constraints.”

Doing the quick math, the estimated $25 million bill divided by the 2,777 tax-liened lots equals out to about $9,000 per lot.

The city expressed concern that its actions align with the best interest regarding the issues plaguing the city.

“No city department exists in a vacuum,” the spokesperson says. “Every need at every department is considered in the context of the city’s need to address education, gun violence, opioids and other pressing issues.”

For the city’s planning department, whose “goal is to create neighborhoods that are well-connected, affordable and desirable places to live and work,” what is the “financial wherewithal” for the opportunity to bring these side yards, gardens and future affordable housing sites into the Land Bank to achieve that departmental mission?

“The truth about the U.S. Bank-liened properties is that they have all been completely abandoned and no one is taking care of them,” Butler offers as his lived experience at the Iglesias Garden Community. “In some cases, the city might be doing very minimal maintenance on them, but in the vast majority of cases it is not. And in the cases where [the lots] are being taken care of, it’s almost always a volunteer effort of people who are working to control it.”

So Butler and the Iglesias Garden Community continue to toil the land without the security of full ownership. Griffin continues to respond to those gardens that call her office every time a sheriff’s sale notice is posted to their fence. And Greenberg continues to work with all of these partners as well as politicians such as Councilmember Kendra Brooks to find, as Greenberg puts it: “A front door or a pathway where I can go and I can say, ‘Here is a community garden, here’s all the benefits it’s providing. Even if I have to fundraise and figure out a price or negotiate a price, how do we start to untangle this so that we can save these gardens?’”

Griffin adds, “I would also encourage people working on a garden to figure out if any of your properties have a U.S. Bank lien. Being empowered is super important, especially with this issue. We actually have given trainings in the past on how to figure out if your property has a U.S. Bank lien on it. So feel free to go to the law center’s website where there are trainings and posts quarterly called ‘Vacant Land 215’.”

Butler’s advice to any Philadelphian, whether a gardener or not, is to let people in power know how important this issue is.

“I would say the elected officials in Philadelphia are the primary people who have the power to solve this problem right now. City Council and the mayor firmly have it within their control to resolve this issue if they are properly motivated to do so. And what we really need is for everyone who’s impacted, even if you’re a member of a community that is indirectly impacted, to let the mayor and your district council person know that you would like to see a resolution here.”

The January 6 “phone zap” may have had some effect: The threatened properties in the Iglesias Garden Community were temporarily removed from the January sheriff’s sale list.

But there will be another auction in February and another after that until Philadelphia sheds the remaining 2,777 U.S. Bank-liened properties.

The only question is: Will there be enough time and political will to save these lots for the gardens and the people of Philadelphia before they’re all gone?

*Ebony Griffin is admitted to practice law in Alabama with admission to the Pennsylvania Bar pending as of this writing.