When Grid was planning a home electrification guide for the January 2025 issue, the universe threw us a curveball. Donald Trump’s reelection as president of the United States cast doubt on the longevity of federal financial incentives for homeowners across the country to purchase solar panels, electric stoves, heat pump HVAC units and other climate-friendly technologies.

So our guide, which walks readers through the who-what-how of electrifying their homes, came with a disclaimer: Republicans may pull the plug on the money to pay for a whole lot of this.

Just months later, we’re standing on the precipice.

Last month the U.S. House of Representatives passed Trump’s cornerstone budget bill, the “One Big Beautiful Bill Act” (yes, that’s its actual name), which puts a range of climate change policies squarely in the crosshairs. The bill would seek to roll back former President Joseph Biden’s landmark climate policy, the Inflation Reduction Act of 2022, almost in its entirety. That legislation earmarked hundreds of billions of dollars for the climate fight over a decade, primarily by providing economic incentives to juice an American clean energy revolution both on the supply side — think tax breaks for solar power manufacturers — and the demand side, with consumer rebates for electric vehicles and home appliances.

But the Big Beautiful Bill aims to kill. The carnage to clean energy sectors is too vast to review here. Heatmap, an online news outlet deep in the weeds, is tracking the proposed changes in detail. Generally speaking, the bill seeks to end many tax breaks and rebates effective January 1, 2026, six years earlier than planned.

That’s indeed the case for many of the economic incentives Grid highlighted in our electrification guide. The bill seeks to sunset at the end of this year 25C and 25D, tax provisions that allow homeowners to deduct thousands of dollars annually for the purchase of home solar panels, heat pumps, electric hot water heaters and even weatherizing products like new insulation, windows and doors. Also targeted are tax credits for the purchasing of new and used electric vehicles, with a one-year extension for automakers who have sold fewer than 200,000 qualifying cars since 2010.

The potential harm here is pretty immense. Transportation is the largest greenhouse gas emitting sector in the United States at 28%, and more than half of those emissions come from everyday cars and trucks, according to the U.S. Environmental Protection Agency. Home energy consumption accounts for another 10% of nationwide emissions, according to the Department of Energy. All in, the nonprofit Rewiring America calculates that about 42% of energy-related emissions in the United States flow from “kitchen table” decisions about what products homeowners and renters decide to buy.

The Inflation Reduction Act (IRA) aimed to make serious progress on all of this, keeping the United States within striking distance of 2030 and 2050 emissions reduction goals that international climate scientists say are needed to avoid the most catastrophic climate scenarios. Its provisions for homeowners were crucial, as domestic electrification provides additional benefits by eliminating the toxic byproducts of gas combustion inside our homes and on our roadways, as well as lowering homeowner utility bills, says Flora Cardoni, deputy director of the nonprofit PennEnvironment.

“For us, the tax incentives are a huge priority because they’ve done a lot to fight climate change and protect our health,” Cardoni says.

So where are we now? First, it’s important to note that this bill is not yet law. Various advocacy and interest groups like Rewiring America and PennEnvironment are waging lobbying campaigns to try to convince Congress not to roll back the IRA. Their strategy had focused on targeting moderate Republicans, especially those with clean tech manufacturers or other relevant economic interests in their districts. Hope was buoyed when, for instance, 18 House Republicans issued a letter to Congressional leadership last August making the economic case to keep at least some of the IRA’s measures intact.

But, those hopes were dashed last month when the Big Beautiful Bill passed the House with only three Republicans not voting yes, and none of them for IRA reasons. In the end, it seems the issue simply wasn’t one any Republicans were willing to die on the Hill for.

Now, all eyes are on the Senate. Again, there are hopeful signs that at least a handful of Republican Senators may be willing to force changes to the IRA rollbacks. Heatmap noted that at least six Republican Senators have signaled some level of interest in keeping some of the incentives, including North Dakota’s Kevin Cramer, who told Politico that his chamber will “have to change” at least the speed of some of the phaseouts.

The magic number to force a change in the Senate is four dissenting Republicans. But whether they too will wilt under immense pressure from Trump and other Republican leaders to pass the bill, and whether or not they will prioritize consumer-facing credits, will be revealed in the weeks ahead.

What can we do?

Practically speaking, it’s probably wise for consumers who want to take advantage of the tax breaks to make any electrification purchases they can this calendar year. Advocates previously encouraged homeowners to electrify over several years, taking advantage of credits and rebates to buy electric-powered appliances as their older gas models broke down, so as to pace the outlay.

But for those with means, 2025 may prove to be the last chance to claim credits for the foreseeable future. As presently written, 25C and 25D will survive at least through the end of the year, and past practice has shown that the IRS will honor the rules come tax time.

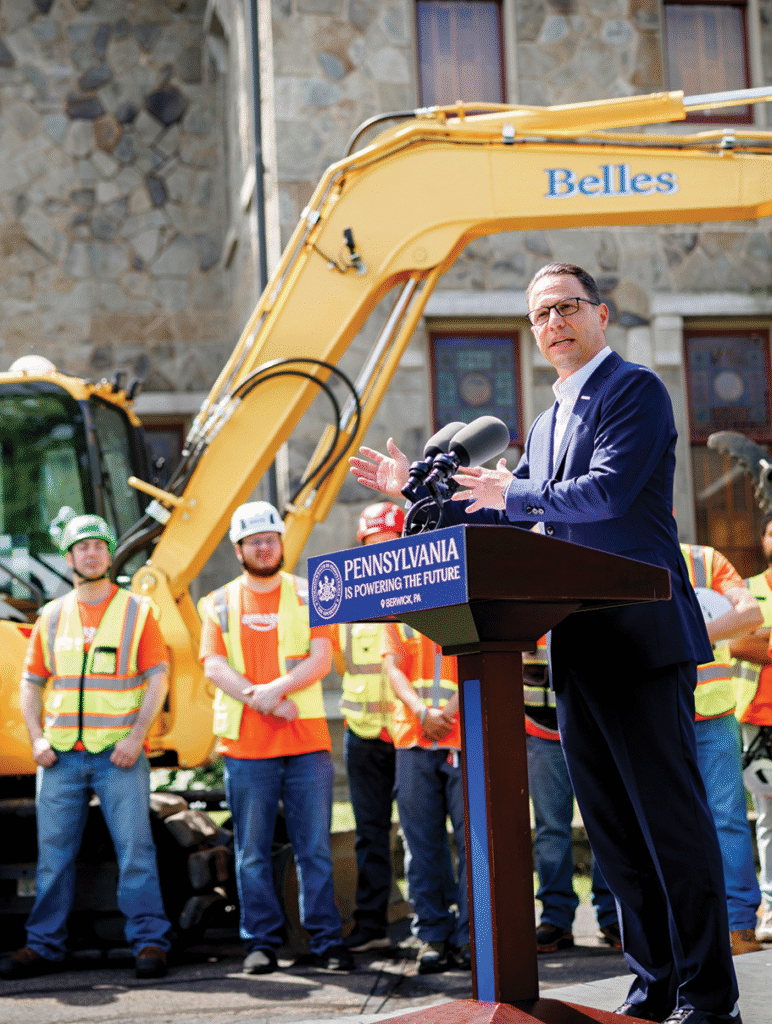

The current status of federal rebate programs called HEAR and HER, which offer even more money for the purchase of electric appliances, is less clear. This spring was supposed to see the launch of the programs here in Pennsylvania, after IRA funding was doled out to states over the past several years. The funds were among those frozen by the Trump administration earlier this year, but Governor Josh Shapiro sued to unlock them. As of June 3, the Pennsylvania Department of Environmental Protection (DEP) website for the HEAR program remained severely outdated, saying it expects the “program to be running by the end of 2024.” A DEP spokesperson did not respond to requests for an update.

If a substantial or full repeal of the Inflation Reduction Act does come to pass, experts say all hope is not lost. Some already question how much of a difference tax incentives like 25C and 25D make for the rate of electrification, as the incentives are typically most accessible for those with higher incomes who both can already afford up-front costs and have enough taxable income to take the deduction.

Researchers such as Oregon State University’s Shawn Hazboun note that some of the biggest electrification gains nationwide can be made in progressive, northeastern cities like Philadelphia, where natural gas infrastructure is prevalent. If the IRA goes dark, area residents of means can keep at least some momentum going by continuing to buy electric appliances and cars in the years ahead, with or without incentives. And everyone can pitch in by advocating at the state and local levels, such as by keeping an eye on potential gas shills and fighting any recalcitrance by utilities like PGW. Cardoni says groups like PennEnvironment are continuing their advocacy efforts on all fronts and encourages others to do the same.

“We’ll continue to organize,” Cardoni says. “I’m cautiously optimistic.”