Floods are expensive. Homes and the possessions inside them are costly to repair and replace, plus displaced flood victims often have to pay to stay elsewhere while their home is made livable again. Here, we unpack the main tool for helping residents handle those costs: flood insurance.

Know your flood risk

Bounded by rivers and compromised by an antiquated sewer system, our city suffers increasing risk of flooding — especially as climate change continues to cause more intense storms. Before you make decisions about flood insurance, you should understand the flood risk you face. Unfortunately, figuring that out is often more difficult than it should be.

The Federal Emergency Management Agency (FEMA) maps the 100-year floodplain, the area that has a 1% chance of flooding each year or over a 25% chance of flooding over a 30-year mortgage. But FEMA’s maps are not the best source of flood hazard information; they often use outdated data and don’t incorporate flood risk from heavy rainfall.

While FEMA maps show just under 2,500 properties in the 100-year floodplain in Philadelphia, climate risk organization First Street’s (firststreet.org) maps, which account for rainfall-related flooding, estimate that close to 110,000 properties face flooding. This year, the Philadelphia Office of Sustainability plans to release new flood maps that will show where residents have reported flood damages in the past and where flooding is expected over the next few decades.

Why is flood insurance important?

Most families don’t have enough savings to cover the costs of a severe flood on their own. Think FEMA will bail you out? Federal disaster aid isn’t always available and even when it is, the payouts are small; FEMA household disaster grants are typically only a few thousand dollars.

Flood insurance is critical to recovery. Lack of flood insurance can widen inequality post-disaster. When more people in a community have flood insurance, local economic activity resumes faster.

What is the National Flood Insurance Program?

For over 50 years, FEMA’s National Flood Insurance Program (NFIP) has provided most flood insurance. Communities such as Philadelphia join the program, adopting certain regulations for new construction in high-risk areas. In exchange, residents can purchase flood insurance.

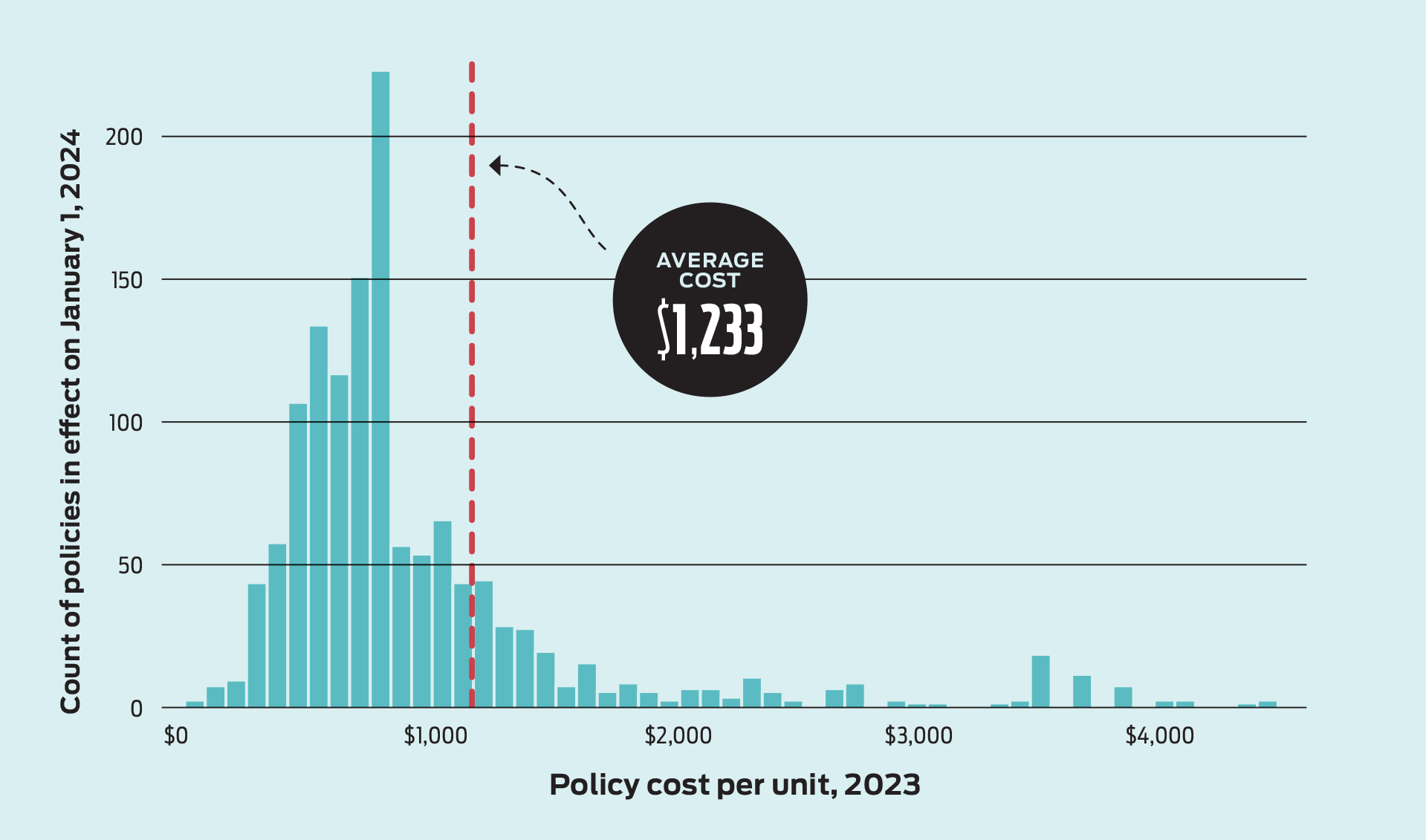

Flood insurance has paid over $1 billion in claims in Philadelphia since 1999. The program currently has roughly 3.1 million policies nationwide and close to 3,700 in our city.

Current flood insurance challenges

The cost of insuring catastrophic risks is high and in flood-prone areas, this is reflected in higher premiums. This can make it unaffordable for those who need it the most.

Pennsylvania’s Flood Insurance Premium Assistance Task Force has proposed improvements at the state and federal level, as well as insurance innovations to help lower flood insurance costs. Policy reforms include Congress providing assistance with premiums for lower-income households — a proposal that has been around for over a decade and is supported by many groups, including FEMA itself.

At the state level, the task force suggested that Pennsylvania could help communities join the NFIP’s Community Rating System program, which offers premium discounts in communities that take steps to reduce overall flood risk. The task force also proposed subsidies for flood risk reduction measures and state tax deductions for flood insurance premiums.

Insurance innovations

The NFIP is not a perfect fit for all households at risk, but new and emerging approaches could help. One currently in development is parametric microinsurance. These are policies that offer smaller limits and lower premiums. They provide fast and flexible dollars that can be used for any disaster needs and pay based on the scale of the flood rather than an assessment of damage.

With the many limitations on what the NFIP will cover and the fact that the median flood insurance claim in Philadelphia is under $900, a parametric microinsurance policy that could quickly provide several thousand dollars or more might appeal to many residents. Other options being explored include nonprofits harnessing insurance to help residents, community-based insurance and embedding insurance in loans for small businesses or vulnerable residents.

What should you know about buying flood insurance?

Anyone in a participating community, like Philadelphia, can buy flood insurance from the NFIP, and you can learn more at floodsmart.gov. Be sure to ask questions of your insurance agent, but also talk to your neighbors and do your own research since agents may not be experts on flood insurance.

Requirements: Anyone at risk can purchase a policy. New policies have a 30-day waiting period before becoming effective.

Coverage details: To protect your home and the stuff inside it, you need to buy both a building (dwelling) policy and a contents policy. Renters can buy a contents-only policy since they are not responsible for structural damage. Each policy will have a maximum payout level, called the coverage cap. In the NFIP, this cap cannot exceed $250,000 for the building and $100,000 for contents. Each policy also has a deductible. Policyholders are responsible for all costs below the deductible.

Coverage additions and restrictions: NFIP does not provide coverage for additional living expenses if you must live elsewhere while your property is repaired or during evacuation. There is very limited coverage in basements. An NFIP policy, however, will pay you up to $1,000 to avoid losses, such as covering the cost of sandbags or supplies needed to protect your property before a flood.

Insurance can provide coverage that is “replacement cost” (insurance pays you enough to replace or repair what is damaged) or “actual cash value” (you only get the depreciated value). While obscure insurance terms, they are critical to having sufficient funds to rebuild. NFIP policyholders are only given replacement cost coverage for single family homes that insure at least 80% of the building’s value (that is, choosing a coverage cap that is close to the assessed structural value of the home). All contents, including carpeting and appliances, are only actual cash value — which typically does not provide enough to buy new replacement items.

Lowering risk and lowering costs: There are a few things homeowners can do to lower both their risk of flood damage and insurance premiums. Proper installation of flood openings and elevating heating and cooling systems, water heaters and electrical panels can help. Other options, like elevating a home, can be extremely expensive.

But households receive premiums between 5% and 45% lower when their community supports flood risk reduction through the Community Rating System. Philadelphia does not currently participate, but some hope that will soon change.

Public or Private: Over 90% of residential flood insurance in the country is provided through the federal NFIP but sold through private firms and agents. There is, however, a small, private flood insurance market, which in Pennsylvania has grown from about 1,500 policies in 2016 to almost 16,000 in 2023. An insurance agent can help you determine if a private firm might offer better pricing or coverage.